Consumer Discretionary is one of my favorite chartbooks to go through. The wide-ranging sector includes everyone from internet retailers like Amazon (AMZN) to restaurants like McDonalds (MCD) to vehicle manufacturers like Ford (F). Such a diverse membership gives us plenty of trends to analyze and lots of underlying themes to think about. If that doesn’t get you excited, congratulations on having a life. For the rest of you nerds, here’s what’s going on in the Discretionary space.

(Wondering why I look at charts? I talk about that here)

S&P 500 Consumer Discretionary Sector

Trouble seeing the levels on my charts? Click the images to view full-sized

Trouble seeing the levels on my charts? Click the images to view full-sized

In 2015, the sector rallied to the 261.8% Fibonacci extension from the 2007-2009 decline. It consolidated for a year and a half, but then managed to break to new highs and rally to the next extension at $946. Since then the sector has had drops and subsequently rallies of more than 20%, but all for naught. It sits at a flat 200-day moving average, lacking clear direction. To reestablish the uptrend in the near-term, a breakout to new highs is needed. On the downside, the January 2018 high near $860 (blue) is important, but a break below $800 would signal potential for a more meaningful trend-change.

Within the Consumer Discretionary sector are 10 industries. Here’s how they stack up.

Uptrends – Price above an upward sloping 200-day moving average

Hotels, Restaurants, and Leisure held up better than most in the fourth quarter of 2018 and managed to set new highs early this year. The next long-term extension (from 2007-2009 decline) lies at $1715, but it’ll be important to hold the 2018 highs at $1280 on this backtest.

Hotels, Restaurants, and Leisure held up better than most in the fourth quarter of 2018 and managed to set new highs early this year. The next long-term extension (from 2007-2009 decline) lies at $1715, but it’ll be important to hold the 2018 highs at $1280 on this backtest.

Specialty Retail is an uptrend at risk of turning trendless. If prices can’t recover above $1200 (shaded) quickly, a long consolidation between there and $980 (blue) could be in store.

Specialty Retail is an uptrend at risk of turning trendless. If prices can’t recover above $1200 (shaded) quickly, a long consolidation between there and $980 (blue) could be in store.

Downtrends – Price below a downward sloping 200-day moving average

Automobiles haven’t really gone anywhere for the last 10 (really 15) years. They broke the swing lows from 2003 and 2006 (upper blue) in the second half of 2018, and more recently failed on an attempt to recapture that level. This week’s break of the $88 support line puts the 2010-2012 rotational area below $70 (lower blue) within focus.

Automobiles haven’t really gone anywhere for the last 10 (really 15) years. They broke the swing lows from 2003 and 2006 (upper blue) in the second half of 2018, and more recently failed on an attempt to recapture that level. This week’s break of the $88 support line puts the 2010-2012 rotational area below $70 (lower blue) within focus.

Auto Components are well below their downward-sloping 200-day. Near-term support lies at the 2011 swing high of $130 (blue). Getting back above the 2007 highs of $154 would be more constructive towards putting in a bottom.

Auto Components are well below their downward-sloping 200-day. Near-term support lies at the 2011 swing high of $130 (blue). Getting back above the 2007 highs of $154 would be more constructive towards putting in a bottom.

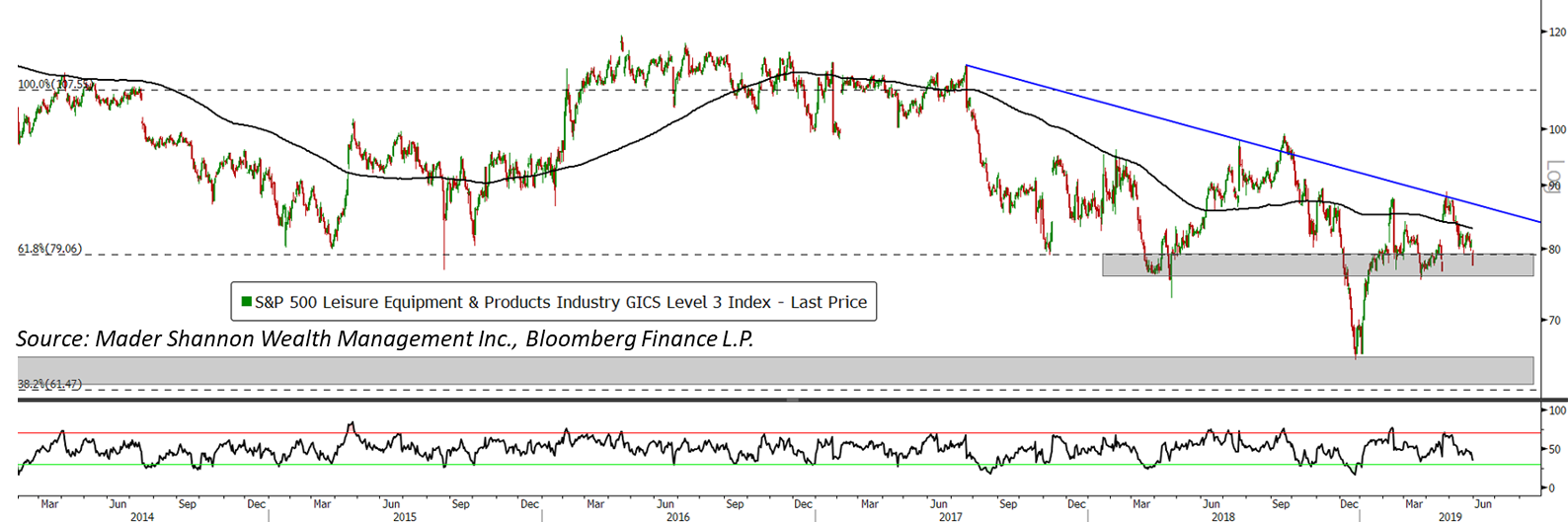

Leisure Equipment & Products are trying to hold this big support level at 76-80 (upper shaded). Below that is more support near 65 from swings in 2008, 2010, 2011, and, 2018 (lower shaded). Breaking the downtrend line (blue) from 2017 would be a positive step towards re-challenging the 2007 highs near $110.

Leisure Equipment & Products are trying to hold this big support level at 76-80 (upper shaded). Below that is more support near 65 from swings in 2008, 2010, 2011, and, 2018 (lower shaded). Breaking the downtrend line (blue) from 2017 would be a positive step towards re-challenging the 2007 highs near $110.

Household Durables are trying to get out of their downtrend. It will help if they can stop the bleeding and hold the rotational area near $300 (lower shaded), but even then it’s a mess to the upside. Five years of chop tends to so that. On the downside, the 2005 highs of $268 aren’t far away, and the Q4 2018 lows are at $250.

Household Durables are trying to get out of their downtrend. It will help if they can stop the bleeding and hold the rotational area near $300 (lower shaded), but even then it’s a mess to the upside. Five years of chop tends to so that. On the downside, the 2005 highs of $268 aren’t far away, and the Q4 2018 lows are at $250.

Everything Else – Trying to establish a trend

Distributors have literally gone nowhere for 5 years. Trading above resistance at $365 (shaded) or below long-term support at $260 (blue) could change that.

Distributors have literally gone nowhere for 5 years. Trading above resistance at $365 (shaded) or below long-term support at $260 (blue) could change that.

The Internet and Catalog Retail space was the belle of the ball for Consumer Discretionary during 2016 and 2017, but now they have one of the flattest 200-days I’ve ever seen. Setting new highs ($8200) is necessary for a new uptrend, but it will take a convincing break of the December lows at $5460 to damage the longer-term structure.

The Internet and Catalog Retail space was the belle of the ball for Consumer Discretionary during 2016 and 2017, but now they have one of the flattest 200-days I’ve ever seen. Setting new highs ($8200) is necessary for a new uptrend, but it will take a convincing break of the December lows at $5460 to damage the longer-term structure.

A break of the 2018 highs for Multiline Retail would put the next extension near $1000 within reach. On the downside, they’ll need to hold the 2008 highs around $700.

A break of the 2018 highs for Multiline Retail would put the next extension near $1000 within reach. On the downside, they’ll need to hold the 2008 highs around $700.

Textiles look poised to retest the 261.8% extension from the 2008 decline (shaded). That area has plenty of memory, so a sustained break below would be significant. For now, though, a continued chop between $720 and $900 shouldn’t surprise anyone.

Textiles look poised to retest the 261.8% extension from the 2008 decline (shaded). That area has plenty of memory, so a sustained break below would be significant. For now, though, a continued chop between $720 and $900 shouldn’t surprise anyone.

Recap

Just like the broader stock index, a lot of the Consumer Discretionary sector is stuck in a multi-year consolidation. A few areas have shown relative strength or weakness, but most are still trying to decide on a direction. I’ll be watching for breaks of some of these key levels as a clue to where we’re headed.

As always, I want to hear your thoughts. Let me know if you have questions or comments about something I’ve written.

Nothing in this post or on this site is intended as a recommendation or an offer to buy or sell securities. Posts are meant for informational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in posts. Please see my Disclosure page for more information.